On March 12, the ECB held a press conference, in which Christine Lagarde announced and commented on the new measures to counter the economic downturn triggered by the spread of the virus. Below, we shortly review and explain these measures, compare the policies of Lagarde and Draghi, the previous ECB president, and give some final considerations on the European choices concerning economic depression related to increasing socioeconomic inequalities within Eurozone.

Monetary relief

The monetary policy package adopted by Lagarde with the unanimous support of the Governing Council is quite like the one that was carried out by Mario Draghi in following his “whatever it takes” purpose. The ECB, as imposed by its mandate, chose to focus on price stability, assessing the liquidity problem that banks and households may get as result of the virus spreading.

The whole package is an attempt to slow down the recession mechanism, ensuring markets and countries that the ECB will not only extend the measures earlier used by Draghi to ensure liquidity to the banks and consequently to the households, but also provide to the affected countries an envelope of €120 billion that can be adjusted in the future following the economy’s conditions.

In other words, the measures will ensure that firms in the countries involved in the recession mechanism will be able to borrow money from banks at lower rate than normal. And that banks will be able to repay interest back to the ECB after a longer period than normally conceived and at lower rate than the one usually offered by the ECB.

How serious is this?

The crisis provoked by COVID-19 seems not as severe as the 2008 one yet, being considered only temporary with the right political response. Still, the measures employed by the respective organs appear to exceed notably those previous ones. Nonetheless, since 2011, we must take into account also the expenditure on the EFSF (European Financial Stability Facility) and the ESM (European Stability Mechanism), both absent at the beginning of the previous crisis and devoted still now to directly assist those countries who suffer the recession the most.

However, there are two things we should consider in assessing the actual conditions. First, the GDP of the EU is nearly €19 trillion, or 16% of the global GDP. Second, these measures are only one part of the actual toolbox of European institutions, that as already showed, could have something to say even in fiscal policy through the application of the ESM’s tools.

Speculation for free

Yesterday we saw the financial indexes having serious decreases, particularly the Italian one fell off nearly 17%, after Lagarde, in what has been a communication mistake, affirmed that the ECB will not close the spreads. However, we should remember that, on the one end, at the time of the first “whatever it takes” the ESM was still to be formed, and on the other that the toolbox of the ECB monetary policy was stronger, since the interest rates were still to be cut by a large portion.

The stock market crisis is the consequence of a market’s behaviour dictated not only by the legitimation, but also the recognition of unlimited richness as preferential status in our economic environment, which stands in front of us as the worst enemy to face in starting to think as a species.

In fact, Lagarde’s declarations, instead of being perceived as an invitation to the Eurogroup next Monday to take extraordinary measures to counter the incoming crisis, have been used as a shield to behave in a completely selfish way despite the seriousness of this period, a behaviour driven by the will to exploit the fragility of the states and citizens to increase individual’s share profits.

A chance for the future

The package approved by the ECB could surely sustain the small and medium enterprises, but what about the people that do not own a firm? What about their children? What about all the people that in this moment are not working, will not receive a subsidy, and maybe will have to pay more taxes? At the end of her speech, Lagarde said: “our analysis is that the response should be fiscal first and foremost” claiming the fundamental importance of appropriate fiscal behaviour from the players interested.

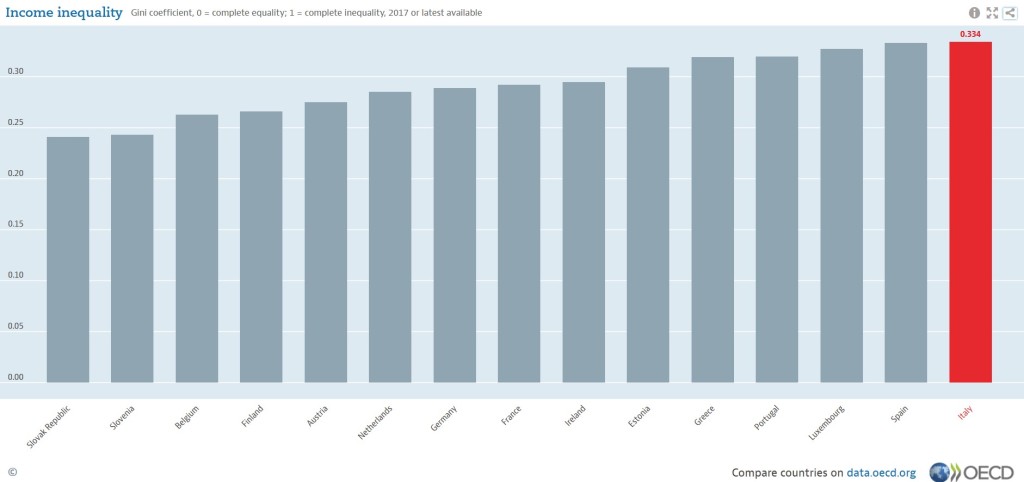

In these days of fear and responsibility, Europe has a chance to show to all Europeans that inequality can diminish, austerity can be substituted by accountability and that fiscal stimuli used in the right way can produce an outstanding amount of human capital that will bring our future generation to live in a world where everyone will have the same opportunities.

But on the off chance that the ESM will adopt measures that will increase inequalities, perceived more because of the crisis, the future for us will be much more difficult. The already existing extreme parties that play with fear and desperation of citizens will have an easy track to the power, resulting in a loss of efficiency and probably of some rights, a perspective that did not seem unreal in Italy last summer, when Matteo Salvini asked for full powers.