Every coin has two faces; same way we will see that low inflation due to poor occasion of consumption and production it is not a synonym of a weak economy. Indeed, even if, across the board, poverty may have increased, savings have raised and they will represent the starting point for recovery.

Analysing the Harmonized Index of Consumer Prices, it is clear that prices have been stable for 3 months since the pandemic outbroke in February. What has happened in this period was firms stockpiling products, with utilities’ price falling dramatically due to both production and sales stand-by. Many companies lowered prices in May, when the lockdown was over, to absorb these inventories and stocks, so prices plummeted. Both production and consumption got a hit in July, maybe because of summer coming in and sanitary conditions getting better; soon after, though, prices went back down dramatically, compared to 2019.

Besides different levels, inflation cycle has been almost the same up to June, when it flipped to the opposite.

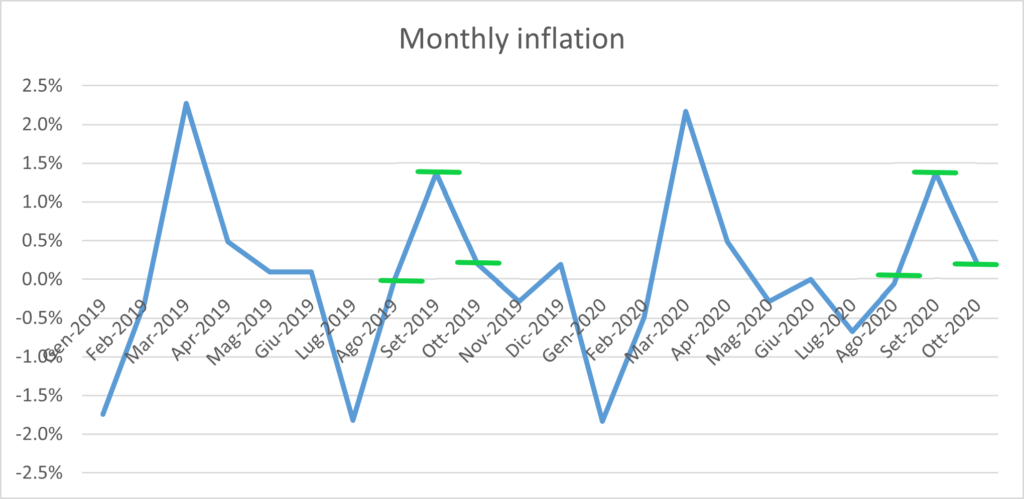

That is what we can see also analysing monthly inflation: comparing price levels on 2019 and 2020 it is clear that the cycle has been stable until May, to slightly change in June and to be definitely different in July. However, this huge surge in July has allowed prices to get back on track, as it is underlined in the figure above (green lines).

So far, assuming no other variation from the trend, i.e. assuming the same monthly change as it was for 2019, inflation will close at -0.2% in 2020, to gradually get back to +1% in 2023 (see figure below).

Considering current pandemic downturns, it is foreseeable a small backstop of consumer prices. Forecasts may fall between -0.2% and -0.3% for the 2020, whit a lower future recover.

What is quite sure, anyway, is that the pandemic dramatically affected Italian economy, bringing consumer confidence to the lowest and savings to the greatest. In my opinion, this should not necessarily be bad-seen: for what I see, we have piled resources to boost future consumption as soon as consumer confidence go back to positive.

In conclusion, whether or not recover comes strongly depends of course on sanitary downturns, but also, and, let me say, most importantly, from economic confidence and political and social stability; even if Covid-19 will “disappear” with spring and/or with available vaccines, the economy still have to show off conditions to set the ground for re-building the future.