Let us now make some irony out of Covid-19’s economic impact.

So far, we have heard many numbers and even more opinions, fun (sad) facts on economy and ways to recover. From where I stand, I have to say that, Yes, numbers are not nice, nor hopeful, but we can make it, on the long run.

I would start from some, not very past in time, facts: in January Italian manufacturing was growing +3.8% on the previous quarter, after a glorious year for markets and a very poor one for economic fundamentals, GDP growth had been slightly positive in 2019. Straight after the pandemic broke out, closing the first quarter with a -5% on a quarterly basis for GDP[1]. Then the second quarter has been even worse: it ended up closing at -13%.

Let me try to give a context to those numbers: lockdown, a.k.a. panic. The solely way to spend money was on grocery and online shopping, the latter being estimated to close 2020 with a good fat +26% at over 20bn euros. Further, 50% of the firms had to shut down production and set up, where possible, the so-called smart working. Consumer confidence was down 5% on March, respect to January and 8% on June respect to march; almost 30 thousand companies failed in the first quarter. Everything let foresee a disaster, air smelled being the same as during financial crises.

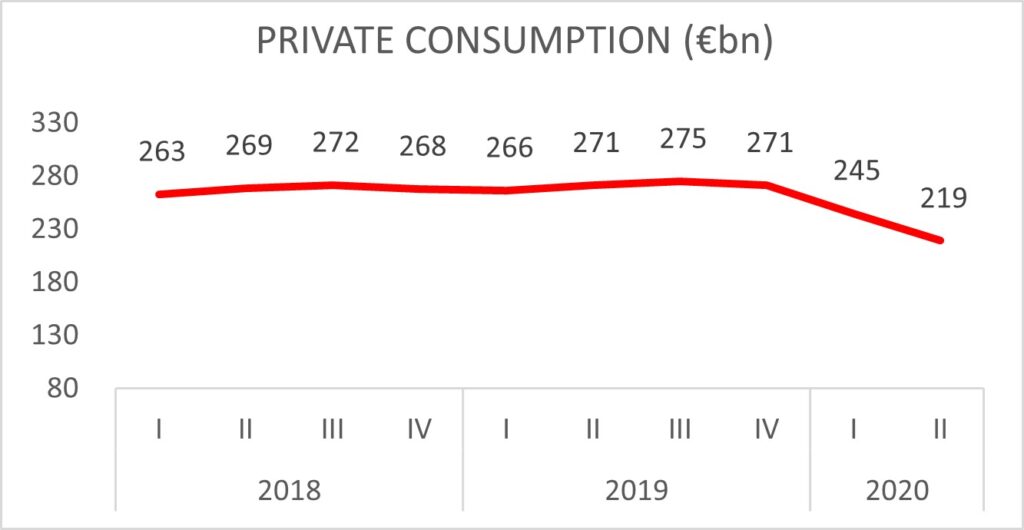

Indeed, as you can see from the figure below, private consumption was down as much as 9.6% each quarter on average, but as I said in the previous article, “A positive view from the analysis of Covid-19’s impact on consumer prices”, this was also because of a huge increase in savings. The saving rate went up to around 12% in March and then to 15% and 18%. A huge saving gut may represent a drama on the one hand and an extraordinarily strong weapon on the other, it depends on how much confident savers are towards the environment. Another way to look at it is through consumer prices: low prices let people delay purchases and starting from June, inflation landed in negative territory.

Now it is the time to give you some good news. In the third quarter, both GDP and Private Consumption rose. In particular, the GDP[2] registered +16% quarter on quarter, and I expect consumption to register a +18%. The loss accrued for the year on GDP seated back at “just” 8.02%. These are all symptoms of a population sharply getting back to normality and living the summer in full. Even consumer prices, except utilities, rose consistently, respect to previous months, and employment started growing too.

Despite all that, as autumn came in, the virus spread out again and, as you will have well guessed, everything I have said so far came back, even though in a softer way. According to the current situation, Italy is divided into three areas, two of which are under lighter regulation: people can work and most of the activities are still open, besides many restaurants, bar, etc., and everyone must be back home at 10 p.m..

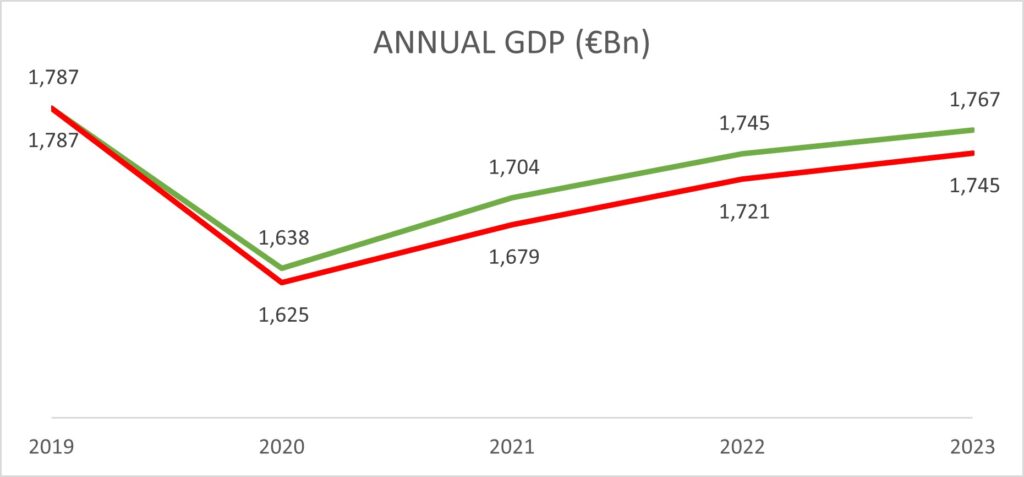

I tried to analyse two possible scenarios. The first one, the “BEST”, according to which restrictions will be lifted on the first half of December and recover for 2021 will be as strong as forecasted by the Italian government to be +4.5%. The second, the “WORST”, in which the lockdown will last until January/February and growth will be weaker than expected in 2021 (around +2.3% instead of +4.5%). Thus, GDP is expected to close the year at -9.3% and -10/-11% respectively, under the assumption of a higher consumer confidence respect to the previous pandemic spread. Either way a full recover won’t occur before 2025.

In conclusion, I might be wrong on estimations, but I think that there is a solid ground for a return to normality and financial stability, on the assumption that every penny will be put in the right pot of course. This means that demand has to surge and savings, toghether with social subsidies, have to flow freely, without any friction nor “clauses”. Finally, Government has to take its place in leading the process harmoniously, expecially because we have seen that 2021 growth speed will make the difference.

[1] I will refer to GDP adjusted for seasonally and calendar effect, but at current prices.

[2] Adjusted for seasonal and calendar effect, at fixed prices (2015).